This blog post has been researched, edited, and approved by John Hanning and Brian Wages. Join our newsletter below.

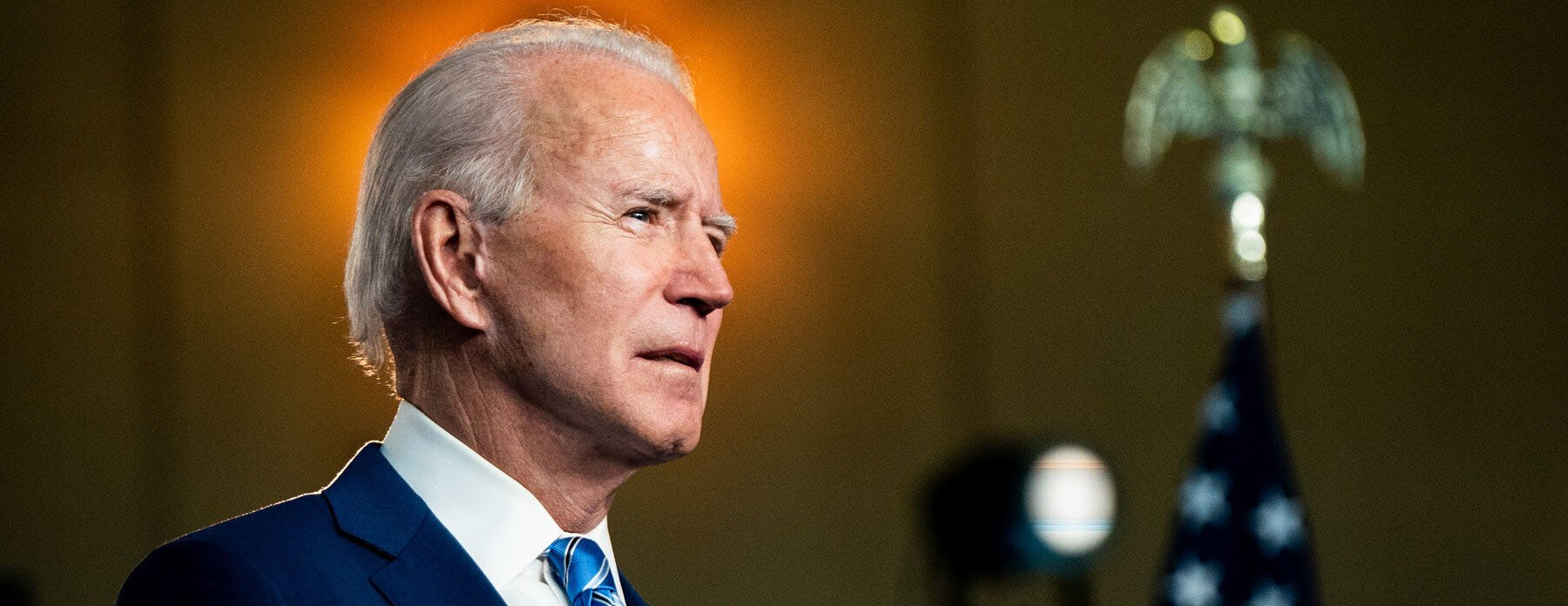

On November 15th, 2021, President Joe Biden signed a $1.2 trillion bipartisan infrastructure bill into law. The bill includes eight new provisions for taxes and Defined Benefits plans.

1. Reporting Requirements To Include Cryptocurrency In 2023

In January 2023, cryptocurrency and other forms of digital assets must be included in businesses’ reports of cash exchanges of over $10,000 to the IRS.

2. Employee Retention Credit (ERC) Was Eliminated

The Employee Retention Credit (ERC) is eliminated effective September 30th, 2021. It was signed into law in the beginning of the COVID-19 pandemic in March 2020, to help struggling small business owners stay afloat.

3. The 60-Day Extension After A Natural Disaster Will Begin Earlier

The automatic 60-day tax extension after a natural disaster will now begin earlier than the incident that caused it. Now, the extension will start either at the time of the earliest event that caused the disaster, or the date that the federal government officially declared a natural disaster.

Furthermore, if the federal government declares more than one natural disaster in a 60-day period, taxpayers receive a separate 60-day extension for each disaster.

4. Interest Rates For Defined Benefits Were Stabilized

Interest rates for Defined Benefits funding requirements were lowered to 105% and are expected to remain at that percentage through 2030. A gradual increase is expected between 2031 and 2034.

5. Tax-Exempt Bond Availability Was Expanded

The infrastructure bill extended tax-exempt bond status to specific infrastructure projects including high-speed broadband for communities with less access to internet, as well as carbon dioxide capture and sequestration facilities.

6. Tolling Time For Tax Court Petitions Was Extended

If a filing location is inaccessible or closed to the public, the time period for filing a tax petition is tolled for the number of days that the location was inaccessible. Furthermore, an extra 14 days is added on top of the toll.

7. The Definition Of Capital Contributions To Water And Sewage Utilities Was Expanded

Under the new bill, any contributions made for the construction of water and sewage facilities are considered “capital contributions” and not taxable income.

8. Six Transportation Taxes Were Renewed And Extended

Finally, the bill renewed and extended six transportation-related taxes.

1. The Section 4661 excise tax on Superfund chemicals was extended from July 1st, 2022, to December 31st, 2031.

2. The Section 4041 tax on the fuel and kerosene used by diesel-powered highway vehicles and trains was renewed through September 30th, 2028.

3. The Section 4081 tax on specific fuels removed from US refineries or terminals, as well as on specific fuels brought into the US for consumption, use, or storage was renewed through September 30th, 2028.

4. The Section 4051 tax on heavy trucks and trailers sold at retail was extended to October 1st, 2028.

5. The Section 4071 tax on specific tires was extended to October 1st, 2028.

6. The section 4481 tax on the utilization of any highway motor vehicle with a taxable gross weight of at minimum 55,000 pounds was extended to October 1st, 2029.

To learn more about these provisions and how they may affect you or your business, contact Specialty Tax Group today.