This blog post has been researched, edited, and approved by John Hanning and Brian Wages. Join our newsletter below.

Newsletter Form

Thank you for joining our newsletter. We will email you the latest updates every other Thursday at 12pm.

Please try again later.

Property owners and investors always look for ways to maximize savings and investment returns. One powerful but little-known strategy is cost segregation. It lets commercial and residential owners accelerate depreciation deductions, increasing cash flow and reducing taxes owed. But what is cost segregation and how can investors benefit? This article explains cost segregation and its tax impacts and potential savings for property owners. Through real-world examples and recent tax law analysis, we’ll show how to use cost segregation for new or existing properties to unlock major tax perks. Read on to learn how this tax planning tool can improve returns on invested money.

Understanding Cost Segregation

Cost segregation is a tax strategy that involves identifying and separating the components of a building for accelerated depreciation. This process classifies various elements of a real estate property into categories with different depreciation lives and accelerates the depreciation deductions on eligible assets, effectively reducing tax liability. By reclassifying assets, business owners can create additional cash flow through lower potential tax liabilities.

How Cost Segregation Reduces Tax Liability

1. Accelerated Depreciation: Assets are classified into different categories such as 5-year, 7-year, 15-year, and 39/27.5-year property—as dictated by the Modified Accelerated Cost Recovery System (MACRS). This reclassification allows for faster depreciation of certain components, leading to an immediate reduction in taxable income.

2. Increased Cash Flow: With lower tax liabilities due to accelerated depreciation, businesses have increased cash flow, which can be used for reinvesting, improving the property, paying down debt, or expanding operations.

3. Compliant with Tax Laws: Cost segregation studies are compliant with IRS guidelines. When performed by a qualified professional, these studies ensure that assets are accurately classified, maximizing the potential benefits while adhering to relevant tax laws.

A pivotal change in the tax landscape affecting cost segregation is the conclusion of the 100% bonus depreciation period at the end of 2022. From 2023 onwards, the bonus depreciation rate is set to decrease by 20% annually. For 2024, the bonus rate stands at 60%, making the strategic use of cost segregation more vital than ever for maximizing tax benefits. Property owners and investors should be aware of these changes and consider how they impact their tax planning strategies.

Real-Life Scenarios

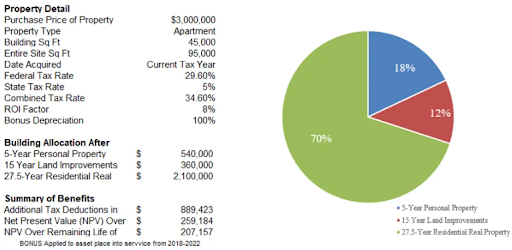

A cost segregation study was performed for an owner of a 312-unit apartment building acquired in June 2021. The results showed 18% of 5-year personal property allocated to the basis; 12% to 15-year; and 70% to 27.5-year property. The study factored in the implications of the 2017 Tax Act, with 100% Bonus Depreciation.

The study allows the Taxpayer to apply $889,423 of additional deductions driving down tax liability in the current year. As a result the Taxpayer was able to use the tax savings to renovate the apartment units in an effort to drive higher rent in future years.

Conclusion

Cost segregation can significantly affect tax liability by accelerating depreciation on eligible assets and ultimately reducing taxable income. For real estate owners and investors, implementing this strategy can lead to substantial cash flow improvements and increased financial flexibility. To make the most of this tax-saving strategy, it's essential to work with a qualified professional who specializes in cost segregation studies.

STG ensures that your business maximizes its tax savings potential through cost segregation.

Contact STG today to learn more about how our cost segregation services can help you improve cash flow, reduce tax liability, and optimize your real estate investment.

2024 Tax Guide

Have A Question?

Contact us today and our friendly team will reach out as soon as possible.

All Rights Reserved | Specialty Tax Group | Powered by Automationlinks | Privacy Policy