Cost Segregation Expertise For CPAs

As the tax code evolves and industries advance, many CPA firms find it challenging to keep up with the latest changes. Specialty Tax Group’s experts will seamlessly integrate with your team, enabling you to offer enhanced services while strengthening your role as a trusted advisor.

What Our Clients Say

“The STG team have always deliver high-quality audit ready deliverables for my clients." — Jonathan

CERTIFIED PUBLIC ACCOUNTANT

“We have used STG to preform a cost seg on every multifamily purchase deal which has increased our federal tax deductions by several million each year.” —Paul

MULTI FAMILY REAL ESTATE OWNER

Button

“STG helped us secure highly specialized tax incentives and cost savings through a comprehensive fixed asset review. Other providers gave me a narrow scope review while STG was able to bring the entire depreciation schedule into compliance." — Becky

NATIONAL RETAILER

Button

“The 45L credit has helped make a big impact to our yearly profits." — Richard

HOME DEVELOPER

Button

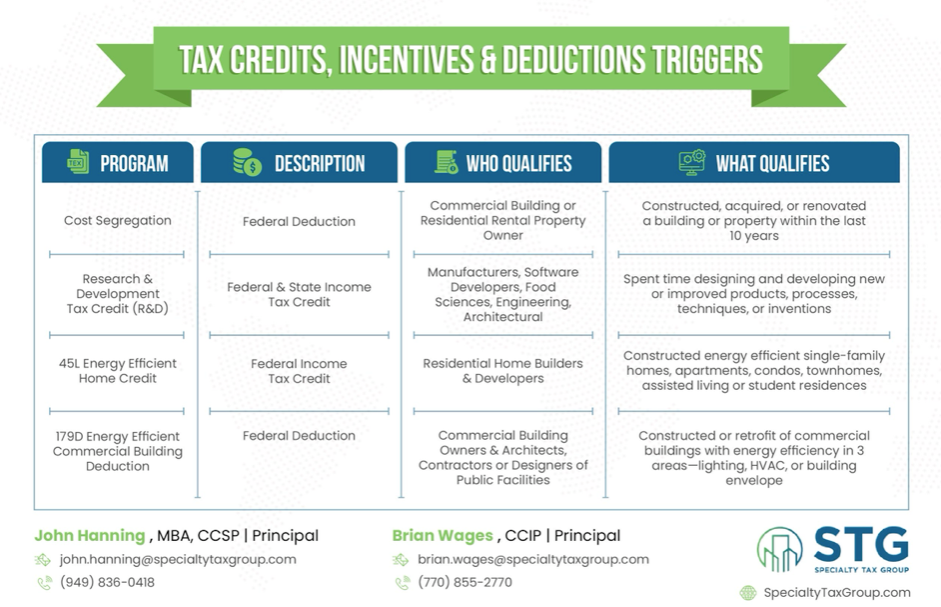

Download our Tax Credits, Incentives & Deductions Triggers Matrix below.

CPA Partner Page

We will get back to you as soon as possible.

Please try again later.

SPECIALTY TAX GROUP

Strengthen Client Relationships

Offering value-added services not only builds trust but also opens doors to new opportunities. With Specialty Tax Group, you can:

Save Time

Our engineers and tax experts will handle the technical aspects, optimizing your clients' tax strategies while keeping your practice running smoothly.

Save Money

We’re committed to maximizing your clients’ tax savings. When they save, you win—our success is tied to theirs.

Expand Your Team

By partnering with Specialty Tax Group, you can offer services like Cost Segregation and R&D Tax Credit Studies without the cost of hiring additional staff.

Testimonials

What Our Clients Say

“The STG team have always deliver high-quality audit ready deliverables for my clients." — Jonathan

CERTIFIED PUBLIC ACCOUNTANT

“We have used STG to preform a cost seg on every multifamily purchase deal which has increased our federal tax deductions by several million each year.” — Paul

MULTI FAMILY REAL ESTATE OWNER

Button

“STG helped us secure highly specialized tax incentives and cost savings through a comprehensive fixed asset review. Other providers gave me a narrow scope review while STG was able to bring the entire depreciation schedule into compliance." — Becky

NATIONAL RETAILER

Button

“The 45L credit has helped make a big impact to our yearly profits." — Richard

HOME DEVELOPER

Button

Services

We focus on Cost Segregation Studies, Energy Efficiency Incentives, Comprehensive Fixed Asset Reviews, Research & Development Tax Credits, Like Kind Exchanges and Accounting Methods. With the knowledge of engineers, CPA’s, HERS raters and LEED Professionals, STG has the ability to deliver tax strategies that are tailored for each client.

Cost Segregation

Services

Cost Segregation is a valuable strategy to increase cash flow and reduce income taxes for commercial property owners.

Georgia Tax Credits

The retraining tax credit allows Georgia businesses to offset their investment in their employees, reduce their Georgia income tax liability, and increase cash flow.

Tennessee Tax Credits

Taxpayers that meet the requirements of a qualified business enterprise, make the required capital investment of at least $500,000 within three years (five years in a tier 3 or 4 enhancement county), and create a minimum number of qualified jobs from the investment may receive a job tax credit equal to $4,500 for each qualified job.

Tangible Property & Repair Reviews

For our most capital intensive clients where we deep dive into the entire depreciation’s schedule.

Accounting Methods

A change in accounting method includes any change in the taxpayer’s overall method of accounting, which often times results in improved cash flow.

REACH OUT TO US BELOW

Learn More About Working Together

CPA Partner Page

We will get back to you as soon as possible.

Please try again later.

Have A Question?

Contact us today and our friendly team will reach out as soon as possible.

All Rights Reserved | Specialty Tax Group | Powered by Automationlinks | Privacy Policy