Reduce Tax Liability and Increase Your Cash Flow with Our Cost Segregation Services!

As a property owner, are you tired of struggling with high taxes and limited cash flow? Cost Segregation could be the solution you've been searching for. With this powerful strategy, you can unlock valuable tax benefits and boost your cash flow.

Get Our Free Cost Segregation Guide

No matter what type of real estate you own, from apartments to restaurants to medical buildings, cost segregation can help you save money and achieve greater financial freedom.

Join Page

SPECIALTY TAX GROUP

Simple & Powerful Benefits

Reduce Tax

Liability

With quick and accurate responses to all your queries, you’ll save time and be more efficient.

Improve Cash

Flow

Our support team is here to ensure that things run smoothly, so you can focus elsewhere.

Capitalize On The Next Investment

Watch your profits and efficiency soar. You’ll expand faster than you ever thought possible.

Our Services

How We Can Help

Cost Segregation Services

Cost Segregation is a valuable strategy to increase cash flow and reduce income taxes for commercial property owners.

Tangible Property & Repair Reviews

For our most capital intensive clients where we deep dive into the entire depreciation’s schedule.

Green Energy Incentives

Here we look for 45L and 179D tax credits relating to developers, owners, architects, contractors and designers of energy efficient homes and buildings.

Comprehensive Fixed Asset Reviews

A Comprehensive Fixed Asset Review reviews a taxpayer’s entire depreciation schedule to ensure the treatment of all assets.

Testimonials

What Our Clients Say

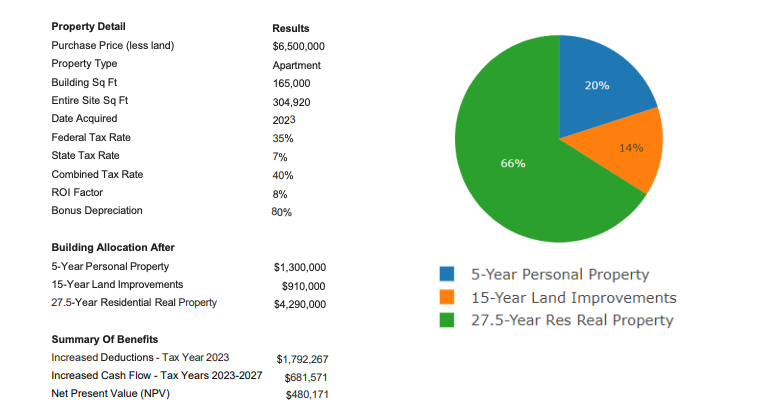

Cost Segregation is a valuable strategy to increase cash flow and reduce income taxes for commercial property owners. The tax benefits of cost segregation can be applied to various types of real estate: apartments, assisted living/nursing homes, auto dealerships, office buildings, restaurants, manufacturing, hotels, medical buildings, retail space and others. The process of Cost Segregation segregating 1245 personal property components 1250 land improvements from the real property of a building, resulting in depreciable lives of 5, 7 and 15 years using accelerated depreciation

Beyond accelerated deductions the Tangible Property Regulations (TPR) allow taxpayers to write off disposed building components as a partial disposition. A cost segregation carves out building components so that a taxpayer can easily identify the deductible cost after a renovation.

Types of Transactions

- New Construction

- Property Acquisition

- Renovations or Expansion

- Leasehold Improvements

- Real Property Step-Up

Get Started Today